Expectations are very low for this earnings season. The challenges are many, with intense cost pressures and slowing economic growth at the top of the list. The chorus of analysts and strategists calling for big cuts to estimates has gotten louder. Expect estimates to come down, but not collapse. Here we take a look at whether expectations are low enough as we preview third quarter earnings season.

Numerous Headwinds

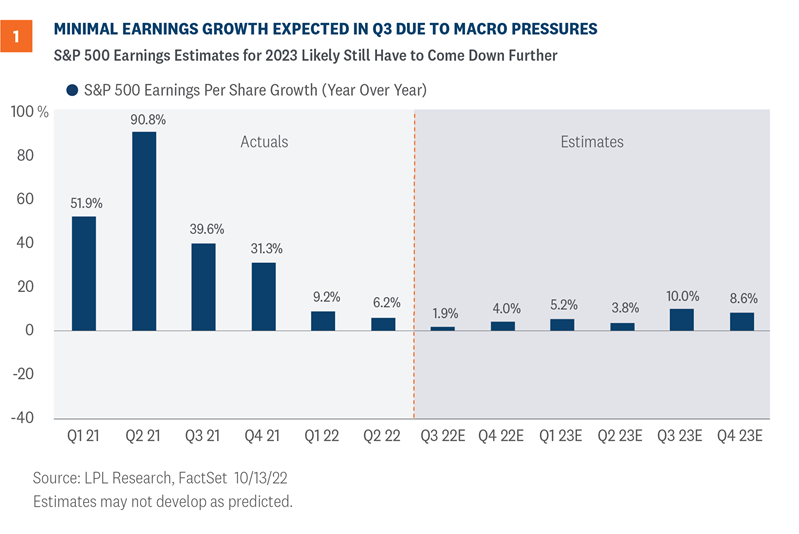

Corporate America has a lot working against it this earnings season. These headwinds include slower economic growth, cost pressures amid high inflation, ongoing supply chain issues, geopolitical instability in Europe and Asia, and significant currency drag from a very strong U.S. dollar. None of this is new news, but it has brought expectations for third quarter earnings growth down by nearly 7% to achievable levels in the 2% range [Figure 1].

That level of earnings growth isn’t very exciting, but thanks largely to the energy sector’s likely more than doubling of earnings on higher oil and gas prices, overall earnings are still likely to grow. The energy sector is expected to add more than six percentage points to overall S&P 500 earnings per share growth for the quarter. That means that the other 10 S&P sectors will likely see an earnings decline even if numbers come in better than expected, as they almost always do. With expectations so low coming into this reporting season, markets could get a boost if earnings were just flat without energy.

There are Some Positives

While the pundits are mostly focused on what can go wrong this earnings season, there are several reasons to expect the numbers for this quarter to be decent. First, companies typically generate about three percentage points of upside, even in challenging profit environments, as they bring expectations down low enough to beat them. During the worst of the Financial Crisis (Q3 2008 through Q1 2009), more than 50% of S&P 500 companies hit their earnings targets each quarter. And during the first quarter of 2020, which included the sudden and unprecedented lockdown of the U.S. economy in mid-March, 62% of S&P 500 companies beat estimates, and aggregate earnings were within one percentage point of expectations.

In addition, it appears that economic activity picked up in the third quarter. After GDP contracted in the first two quarters, GDP growth may approach its pre-pandemic 2% trend for the third quarter—consensus forecasts tracked by Bloomberg call for 1.8%, while the Atlanta Fed’s real-time GDP “nowcast” is tracking to a solid 2.9%.

Finally, generating earnings growth in a tough economic environment is a little easier when inflation is the source of the weakness. The consensus estimate for year-over-year revenue growth for the S&P 500 in the third quarter is 8.5%. Higher prices mean more revenue for companies. Results from companies that are able to maintain pricing power and pass higher costs along to their customers are likely to be well received.

Here’s What’s Worrisome

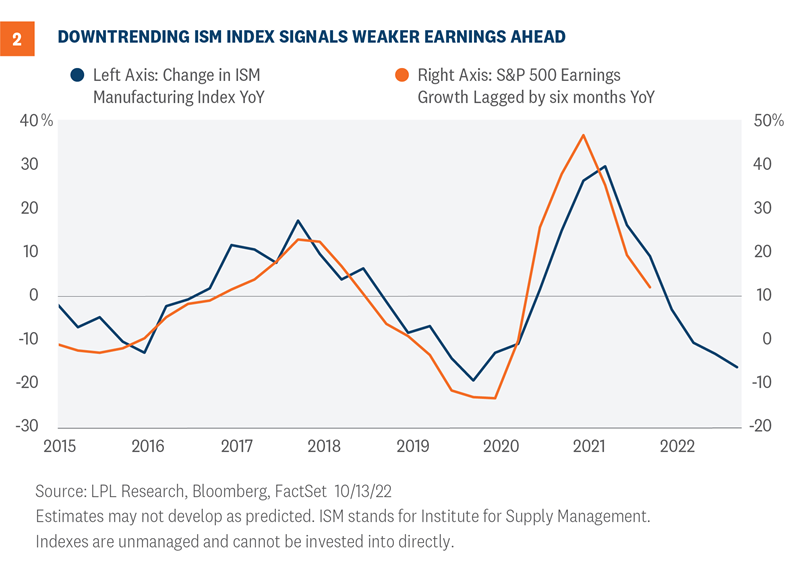

With many corporate executives preparing for recession as the odds have increased, it’s prudent to look at potential downside. One way to assess downside is to look at the historical relationship between the Institute for Supply Management (ISM) Manufacturing Index and earnings growth. The S&P 500 is more manufacturing-heavy than the U.S. economy, as measured by gross domestic product, so the ISM index tends to have some predictive power when it comes to earnings.

As shown in Figure 2, the direction of this index is pointing to a potential double-digit decline in earnings per share over the next six to 12 months. That is more pessimistic than our current house view, but it is certainly possible. That level of earnings weakness, which would put S&P 500 earnings per share in the $200 to $205 range next year, would align with historical earnings declines during the inflation driven recessions of the 1970s.

Margins and Guidance are Keys

Earnings estimates for 2023 are too high—this is about as consensus as a view gets. The tough part is figuring out how far estimates need to fall and how much of a headwind that haircut will be for stocks as they try to dig their way out of this bear market.

The consensus S&P 500 earnings per share estimate for 2023 is currently $240, down from $250 at the end of June. Our recently lowered forecast stands at $230, down from $235 last month. The lowered forecast assumes inflation pressures ease enough in 2023 to help support margins in the second half of next year. That doesn’t change the fact that margins have to come down and recession risk will remain high as the inflation fight continues.

We acknowledge that margins need to come down further after only coming in about a half point so far. Wages have been rising amid ongoing labor shortages. Supply chain disruptions related to China’s zero-COVID-19 policy persist. Retailers still have inventory problems. Companies were essentially overearning during the pandemic, so some mean reversion still needs to occur. Some of these pressures have started to ease, but lower commodity prices and slightly looser labor markets have had limited impact thus far.

Bottom line, we would look for another half point or so to come out of operating margins over the next two to three quarters, bringing them down to pre-pandemic highs. But look for revenue growth and progress on inflation throughout 2023 to enable S&P 500 companies to at least match 2022 earnings—now tracking to $223—in 2023.

Conclusion

Companies almost always beat expectations because the bar is lowered enough for them to step over it. Third quarter should be no exception.

The key, as always, will be guidance. Estimates will surely come down to reflect slower growth, higher inflation, and the stronger dollar. But given companies’ demonstrated ability to manage rising costs in recent quarters and the boost that inflation provides to the revenue line, we don’t expect estimates to collapse.

No doubt there will be hits and misses—there already have been with disappointing August results from FedEx paired with better-than-expected results from the likes of JPMorgan, PepsiCo, and UnitedHealth. But overall, we would expect modest estimate cuts to be received positively by markets, supported by lower valuations and depressed investor sentiment.

Much of this bear market has been driven by lower valuations, with the forward price-to-earnings ratio (P/E) for the S&P 500 Index having dropped from over 21 at the start of the year to below 16 currently. Looking ahead, although an eventual Federal Reserve pause (likely a Q1 2023 event) and a lower 10-year Treasury yield (3.5% rather than 4%) could prop up valuations, stocks will likely take their cues from earnings in the near term. Any earnings gains in coming quarters will be hard earned and minimal, but likely well received.

Quincy Krosby, Ph.D. Chief Global Strategist, LPL Financial

George Smith, CFA, CAIA, CIPM, Portfolio Strategist, LPL Financial

You may also be interested in:

- Pockets of Vulnerability Magnified by Monetary Policy – October 10, 2022

- Markets on Watch as Xi Jinping’s Influence to Be Tested in October – October 3, 2022

- Why It May Be Time to Take Advantage of Higher Yields – September 26, 2022

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered inv estment advisor and broker -dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment a dvice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

RES-1303200-1022 | For Public Use | Tracking # 1-05338579 (Exp. 10/23)