The Federal Reserve (Fed) enters 2026 navigating potentially constrained policy conditions as resilient growth and above‑trend inflation intersect with an increasingly unsustainable fiscal trajectory. Fed Chair Jerome Powell emphasized that federal debt growth requires eventual corrective action, even if near‑term market risks remain limited. Rising primary deficits at near full employment further limit long‑run policy flexibility, while expanding Treasury financing needs — and a growing reliance on short‑duration bills — heighten rollover risk and amplify sensitivity to the Fed’s policy rate.

Compounding these challenges, President Trump has now nominated Kevin Warsh to succeed Chair Powell, positioning a policy‑discipline advocate to inherit elevated debt levels, politically sensitive rate decisions, and deepening Fed–Treasury interdependence. Against this backdrop, investors may benefit from maintaining balanced duration exposure, favoring high‑quality fixed income sectors, and preparing for tactical opportunities should policy or issuance dynamics shift.

A Dovish Hold

At last week’s Federal Open Market Committee (FOMC) meeting, the Committee delivered what could be described as a dovish hold: policy is “well positioned,” the economy looks solid, there were “some signs” of stabilization in the labor market, and the Fed is confident that tariff-induced inflation will be transitory. Ultimately, the FOMC voted 10–2 to keep rates unchanged. Two voters — Waller and Miran — dissented in favor of a cut. Last meeting, in which the FOMC cut interest rates by 0.25%, several members dissented for various reasons, including two who wanted no change to interest rates. By all accounts, the Committee remains pretty divided on the future path of interest rates.

From the released statement and subsequent press conference, it seems most officials think labor markets are showing signs of stabilizing. That’s different than the view espoused in December of ongoing weakness in the labor market. As well, officials removed the statement about “downside risks to employment.” This is consistent with the confusing signs we currently have of low unemployment claims numbers but also low hiring rates across industries. Finally, there were no more shifting balance of risks. This is extremely noteworthy for how we build expectations for future FOMC meetings.

The main message from the January FOMC meeting was that better growth news and early signs of labor market stabilization left the Committee feeling well-positioned — a term Fed Chair Jerome Powell used five times — to remain on hold while they assess the incoming data. Powell described the policy stance as “loosely neutral” or “somewhat restrictive” and noted that the December dot plot showed that 15 of 19 FOMC participants anticipated additional normalization. He reiterated his own optimistic interpretation of the inflation data and said that he expects tariff effects on inflation to eventually fade, at which point “we can loosen policy.”

Bottom Line: Given the more likely FOMC view that the dual risks of inflation and unemployment are mostly in balance, we should not expect any change in policy at the next FOMC meeting in March. Further, the March meeting will include the updated Summary of Economic Projections, which should provide further clarity on how the Committee sees the balance of risks between stable prices and full employment. That said, we expect the first cut will come later this year, as inflation should decelerate with housing pressures easing and businesses moving past tariff pass-throughs.

The Fed Chair Sweepstakes

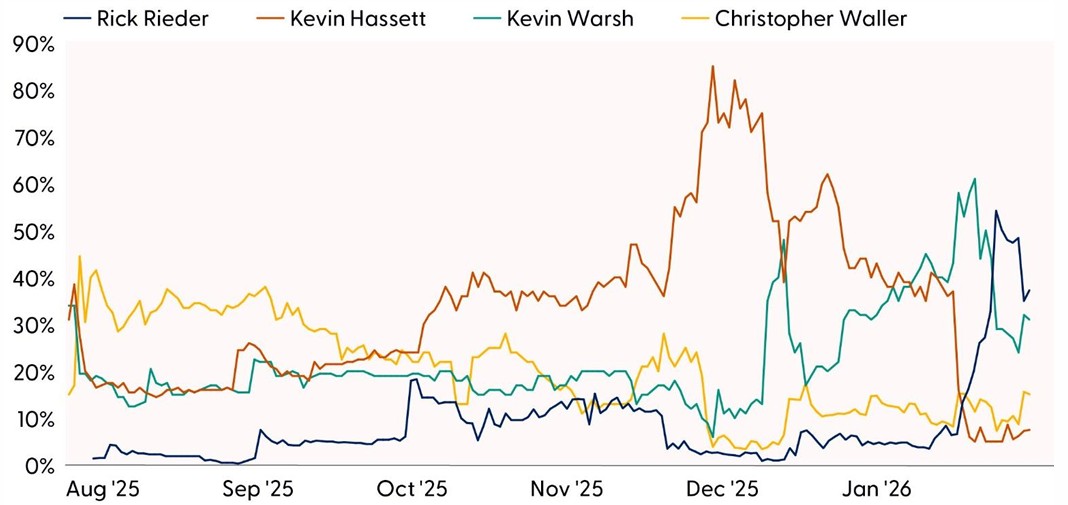

While the FOMC meeting went largely as expected, uncertainty had persisted for months over who would ultimately succeed Fed Chair Jerome Powell once his chairmanship ends in May 2026 (though his term as Governor continues through January 2028). Throughout the interview process, Treasury Secretary Scott Bessent evaluated four candidates: Kevin Hassett, Kevin Warsh, Christopher Waller (current Fed Governor), and Rick Rieder. Three were economists by training, while Rieder brought practical fixed income market experience.

For much of this period, markets lacked clarity on which candidate would emerge as the frontrunner, with betting markets rotating among the four and elevating each as the favorite at various points over the past six months. Ultimately, the uncertainty resolved only at the end of the process, when President Trump nominated Kevin Warsh for the role — confirming what had previously been only one of several plausible outcomes.

Shifting Expectations: Who Markets Saw as the Next Fed Chair

Source: LPL Research, Polymarket 01/29/26

Disclosures: Past performance is no guarantee of future results.

With five years of history on the Board of Governors under the Bernanke Fed, Kevin Warsh was known as Bernanke’s bridge to Wall Street during times of crisis. Less an Academic, more a battle-tested Financier. Warsh is also known as a critical thinker and should have no problem getting confirmed. He will not likely act as a yes-man. His recent speech to the IMF, “Setting Aside Central Bank Fast Food”, is noteworthy in several areas, and we believe this speech defines Warsh as a defender of central bank independence. Investors should be thankful. Investors could get nervous with Warsh’s view that many current monetary frameworks are just junk food, such as forward-guidance and data-dependency. We think these views could potentially be hazardous and a risk if not carefully refined. Foreign exchange markets should appreciate Warsh’s stance on current fiscal policy.

Bottom Line: Warsh is a safe pick, having only had a muted impact on capital markets so far. He’s forthright, willing to rethink convention, and may not necessarily be a ‘yes-man’ for the President. Last year’s speech is a must-read as investors anticipate how the policy framework may change under a new chair. His next role, if confirmed by the Senate, may be trying to convince a divided Fed that aggressive rate cuts are warranted despite still elevated inflation readings. The Treasury yield curve steepened after the announcement with shorter-maturity yields falling while longer yields moved marginally higher as markets started to price in the possibility of more rate cuts this year.

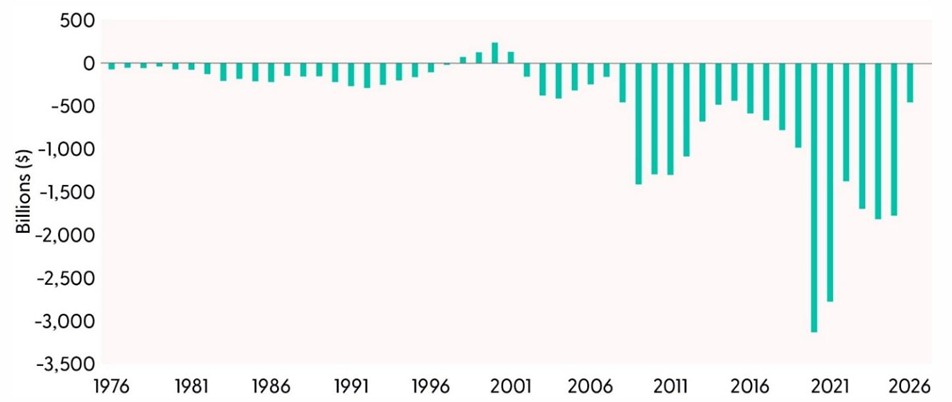

“The Path is Unsustainable”

During last week’s press conference, Chair Powell cautioned that the growth trajectory of U.S. federal debt is unsustainable and will eventually require action, even though he does not foresee it triggering any near‑term market disruptions. He emphasized that while the current level of debt remains manageable, “the path is unsustainable and the sooner we work on it, the better.” Powell also highlighted concerns about the fiscal outlook, noting that the U.S. is running a substantial deficit despite operating near full employment — an issue he said must be addressed but currently is not.

And he’s not wrong. As of December 31, 2025, total U.S. debt outstanding was $38.5 trillion (with a T) and with budget deficits still averaging between 4%-6% of GDP, expected debt levels will continue to grow. Since 2020, the federal government has added over $15 trillion to public debt levels — it previously took 15 years (from 2005 to 2020) to add a similar amount of debt. Deficits have been improving since President Trump took office, driven by tariffs, the removal of 2021 fiscal stimulus, and wage growth. But during the last fiscal year, the government brought in over $5 trillion, but with government expenditures more than $7 trillion, the difference needs to be financed with debt. Ongoing budget deficits will continue to add to the growing debt levels.

Larger Budget Deficits = More Treasury Issuance

Source: LPL Research, Bloomberg 01/29/26

Disclosures: Past performance is no guarantee of future results.

Treasury Borrowing Needs in Focus This Week

Related, every quarter, the Treasury Department releases its upcoming borrowing needs for the following quarters. The Quarterly Refunding Announcement (QRA), as it’s called, is released on the first week in February, May, August, and November, providing details on the government’s borrowing plans for the upcoming quarter. The QRA announces specific auction sizes for the coming quarter’s nominal coupon securities across the Treasury curve — 2 year, 3-year, 5-year, 7-year, 10-year, 20-year, and 30-year maturities. Treasury also provides updated financing need estimates and occasionally discusses changes to its issuance strategy.

Also, the announcement includes minutes from the Treasury Borrowing Advisory Committee (TBAC), a group of primary dealers and market participants who advise on debt management. These minutes sometimes offer useful insights into market structure considerations and future policy directions.

In most quarters, the QRA confirms what markets already expect. Treasury typically adjusts auction sizes gradually and incrementally, telegraphing changes well in advance through TBAC discussions and previous announcements. A $1–2 billion increase in 10-year auction sizes, for example, rarely moves markets because it’s either anticipated or too small to materially shift supply-demand dynamics.

The QRA becomes important, however, during extraordinary periods or when borrowing plans deviate from market expectations. Debt ceiling resolutions create uncertainty about how quickly Treasury will rebuild its cash balance and where that borrowing will be concentrated across the curve. Major fiscal trajectory changes — like pandemic related deficit expansion or significant tax policy shifts — can make issuance path forecasts more uncertain, giving the QRA actual information content.

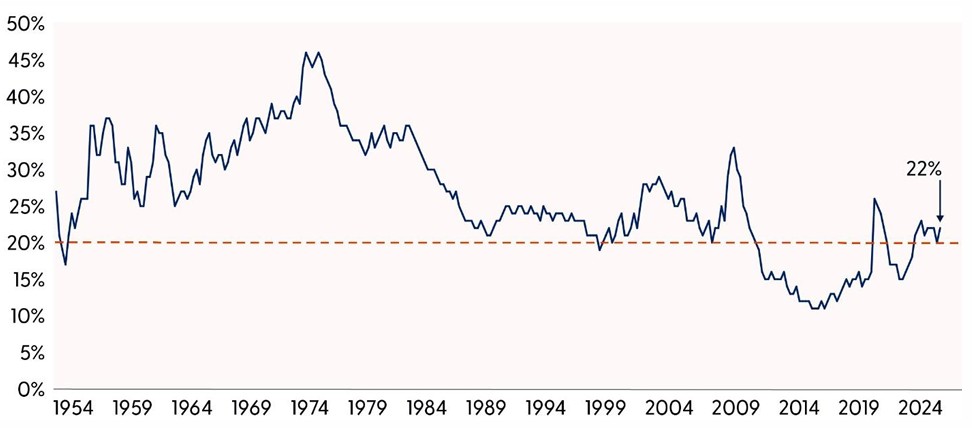

Funding Mix Tilts Short

This week’s QRA is expected to be on the more muted side as Treasury has projected coupon stability until later this year, at the earliest. Market expectations are for Treasury to boost its near-term borrowing projections when it releases its financing estimates at 3 p.m. on Monday, February 2; marketable borrowing is estimated to be $640 billion for Q1 (vs. $578bn projected at the November refunding meeting). No changes are expected to nominal coupon or TIPS auction sizes this quarter, implying net Treasury bill supply of $326 billion for Q1.

Of note though, since no change to the amount of coupon issuance is expected, Treasury bill issuance will likely continue to be a larger share of total Treasury issuance. Currently, bill issuance represents 22% of total issuance — which is above the 20% ceiling that the TBAC has recommended — and looks to be headed higher. Both Bessent and Trump have noted that long-term interest rates are still high (the weighted average coupon of existing Treasury debt is around 3%), so refinancing debt using coupon-paying securities (Treasury tenors from 2-year to 30-year) at current levels would increase interest expenses, which already makes up roughly 20% of tax receipts. As such, the administration has leaned into using more bills to finance deficits.

Treasury bills have a maturity of 1-year or less with yields that are very close to the fed funds rate. This, of course, increases the frequency with which the debt needs to be refinanced (since the government doesn’t actually pay down its debts) but also increases the sensitivity of government financing costs to the Fed’s actions — one reason Trump has called for the Fed to aggressively lower interest rates. With the Fed likely on pause at least until the summer, government financing costs will remain elevated, potentially compounding the unsustainable path of U.S. government debt levels.

Treasury Bills Share of Total Treasury Issuance Likely to Grow

Source: LPL Research, Bloomberg 01/29/26

Disclosures: Past performance is no guarantee of future results.

The Bottom Line

The growing interdependence between Fed policy and Treasury financing needs suggests investors should expect periods of rate‑driven volatility, particularly as rising bill issuance increases the government’s sensitivity to the policy rate. With the Fed likely to remain on hold until clearer disinflation trends emerge and Treasury relying more heavily on short‑duration funding, interest‑rate markets may stay range‑bound but volatile at the front end. Elevated deficits and the transition to a new Fed Chair introduce additional uncertainty around the policy path. Against this backdrop, investors may benefit from maintaining balanced duration exposure, favoring high‑quality fixed income sectors, and preparing for tactical opportunities should policy or issuance dynamics shift.

Asset Allocation Insights

LPL’s Strategic Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities. Investors may be well served by bracing for occasional bouts of volatility given how much optimism is reflected in stock valuations, but fundamentals remain broadly supportive. Technically, the broad market’s long-term uptrend remains intact, leaving the Committee biased to buy potential dips that emerge.

STAAC’s regional preferences across the U.S., developed international, and emerging markets (EM) are aligned with benchmarks, though an improving technical analysis picture in EM is noteworthy. The Committee still favors the growth style over its value counterpart, large caps over small caps, the communication services sector, and is closely monitoring the healthcare, industrials, and technology sectors for opportunities to potentially add exposure.

Within fixed income, the STAAC holds a neutral weight in core bonds, with a slight preference for mortgage-backed securities (MBS) over investment-grade corporates. The Committee believes the risk-reward for core bond sectors (U.S. Treasury, agency MBS, investment-grade corporates) is more attractive than plus sectors. The Committee does not believe adding duration (interest rate sensitivity) at current levels is attractive and remains neutral relative to benchmarks.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet or Bloomberg.

This research material has been prepared by LPL Financial LLC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0006657-0126 Tracking #1057150 | #1058401 (Exp. 02/27)